In today's digital age, scams are prevalent, and scammers continuously devise new methods to target unsuspecting individuals. One of the most insidious scams that have been rising recently is tax-related scams. These scams often involve fraudulent callers posing as tax agents, attempting to convince victims to divulge sensitive financial information or make payments for fictitious debts.

Fortunately, a simple yet effective tool can provide a formidable defense against these scams: a call blocker.

Understanding the Threat: Tax Scams

Before diving into the effectiveness of call blockers in combating tax scams, it's essential to understand the nature of these threats. Tax scams typically involve a caller claiming to be a tax agent or representative, informing the recipient that they owe unpaid taxes or have committed a tax-related offense. The caller may use intimidation tactics, such as threats of legal action or arrest, to pressure the victim into complying with their demands.

False Tax Debt Claims

Scammers often fabricate claims that the victim owes unpaid taxes, insisting that immediate payment is necessary to avoid severe consequences. They may cite fictitious discrepancies in tax filings or unpaid taxes from previous years, creating a sense of urgency and fear.

Legal Action Threats

Employing intimidation tactics, scammers threaten victims with legal action if they fail to comply with their demands. These threats may include imminent arrest, lawsuits, or the involvement of law enforcement agencies. The goal is to instill panic and coerce the victim into swift compliance.

Impersonation of Tax Agents

Fraudulent callers masquerade as tax agents or representatives, exploiting the authority to manipulate victims. By impersonating legitimate authorities, scammers aim to establish credibility and legitimacy, making it more likely for victims to trust their claims and comply with their demands.

Spoofed Caller ID

Scammers use spoofing techniques to manipulate caller ID information to enhance their deception. By falsifying the caller's identity to make it appear that the call originates from a trusted entity, scammers increase the likelihood of their victims answering the phone and falling for their schemes.

Urgency and Pressure Tactics

Scammers employ tactics that create a false sense of urgency, pressuring victims to take immediate action to avoid supposed consequences. They may assert that failure to comply promptly will result in severe repercussions, such as arrest, asset seizure, or legal penalties. This urgency leaves victims with little time to verify the legitimacy of the caller's claims and increases the likelihood of compliance.

Threats of Asset Seizure

Scammers often threaten victims by seizing their assets if they do not comply with their demands. They may claim that unpaid taxes will lead to confiscation of bank accounts, homes, vehicles, or other valuable assets. These threats are designed to intimidate victims and coerce them into making payments to avoid imagined losses.

Personal Information Requests

Scammers frequently request sensitive personal information from their victims, such as Social Security numbers, bank account details, or passwords. They may claim this information is needed to verify the victim's identity, process payments, or rectify alleged tax issues. Providing such information puts victims at risk of identity theft and financial fraud.

Fake Tax Refunds

Scammers sometimes promise victims tax refunds or financial incentives to lure them into providing personal or financial information. They may claim that the victim is entitled to a refund for overpaid taxes or offer bogus incentives as part of a phony government program. These false promises are used to gain the victim's trust and manipulate them into divulging sensitive information.

Phishing Attempts

Scammers may resort to phishing emails or texts posing as trusted entities. These messages typically contain links to fake websites or attachments designed to steal personal information or install malware on the victim's device. Unsuspecting recipients who click on these links or download attachments may inadvertently compromise their personal and financial security.

Threats of Legal Consequences

Scammers frequently threaten victims with dire legal consequences, including hefty fines, penalties, or even imprisonment if they do not comply with their demands. These threats are intended to scare victims into submission and discourage them from seeking assistance or questioning the legitimacy of the caller's claims.

The Role of a Call Blocker

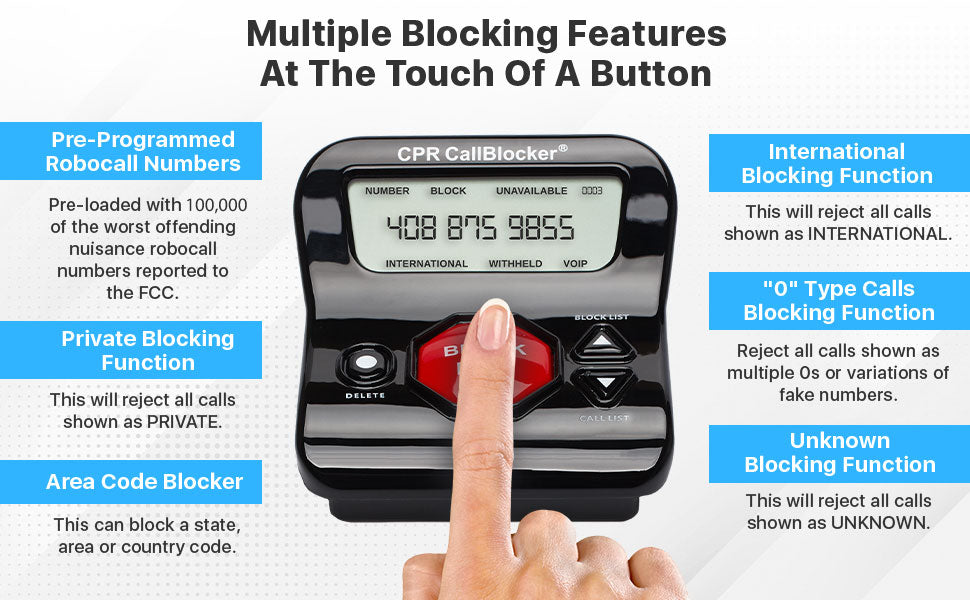

A call blocker is a device or software application designed to screen incoming calls and block those originating from numbers identified as spam, telemarketers, or other unwanted sources. While call blockers serve various purposes, one of their most significant benefits is protecting users from scams and fraudulent calls, including tax scams.

By implementing a call blocker, individuals can effectively shield themselves from unwanted and potentially harmful calls, including those from scammers posing as tax agents. Call blockers utilize advanced algorithms and databases to identify suspicious numbers and automatically block them before they reach the recipient.

Blacklisting

Call blockers maintain a database of known scam numbers, telemarketers, and other unwanted callers. When an incoming call matches a number on the blacklist, the call blocker automatically rejects it, preventing it from ringing through to the recipient.

Caller ID Analysis

Call blockers analyze caller ID information to detect inconsistencies or signs of spoofing. They may compare incoming numbers against known patterns associated with scam calls, enabling them to identify and block fraudulent calls quickly.

User Feedback

Some call blockers allow users to manually report unwanted calls. When a user identifies a call as spam or a scam, the call blocker updates its database accordingly, improving its ability to identify and block similar calls in the future.

Benefits of Using a Call Blocker

Peace of Mind

With a call blocker, individuals can enjoy peace of mind knowing they are protected against unwanted and potentially harmful calls, including tax scams.

Time and Energy Savings

By automatically screening and blocking unwanted calls, call blockers save users time and energy that

would otherwise be spent dealing with nuisance calls and scams.

Protection for Vulnerable Individuals

Call blockers are particularly beneficial for vulnerable individuals, such as older people, who may be more susceptible to scams and fraudulent calls.

Cost Savings

Falling victim to a tax scam can result in financial losses. Call blockers can help individuals avoid costly mistakes and protect their finances by preventing these scams from reaching their intended targets.

Conclusion

In an era of scams and fraudulent calls, protecting oneself against tax scams is more important than ever. A call blocker provides a simple yet effective means of defense, enabling individuals to safeguard their finances and personal information from fraudulent callers. By automatically screening and blocking suspicious calls, call blockers offer peace of mind, time savings, and protection against costly scams.

For anyone concerned about falling victim to tax scams, investing in a call blocker is a wise and proactive step toward ensuring financial security and peace of mind.

Please browse our selection of products or contact us so we can assist you.